-

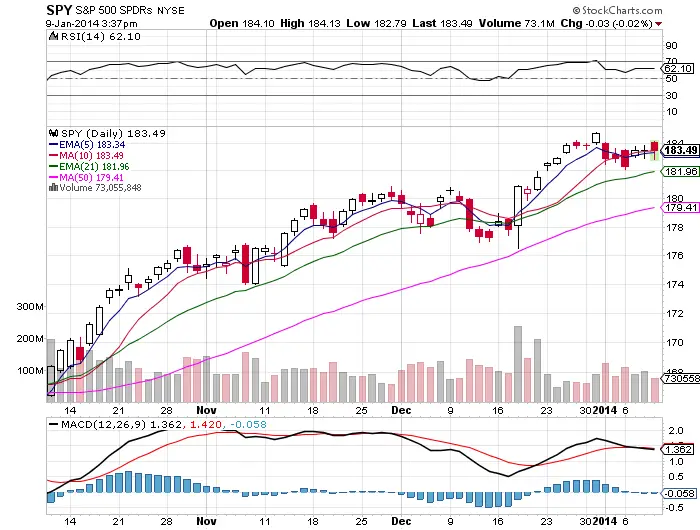

The primary eleven day range is $182 support/$184 resistance. The one day gap up break above $184 was rejected so far.

-

^Short term $SPY is currently range bound.

-

The long term up trend is currently still strong and in place.

-

$SPY opened at the highs of the day and could not find any buyers above the opening level. This is how downtrends start, open high end low.

-

I do not see a good probability long entry at these levels until we either form a longer price base or have a small retracement to give a better potential risk/reward entry.

-

If we break out above the $184 short term resistance we could see a return to all time highs but the 70 RSI will be hanging over head as resistance if we get there.

-

If we do have a rally up to the 70 RSI that level will provide a great risk/return short play.

-

$184 could be a short play with the potential for $SPY to at least return to the $182 support to cover at.

-

A break and close below $182 could signal the loss of short term support and a potential fall to the 50 day sma.

-

I will be patiently waiting for a signal. I am currently holding bearish credit spreads using $SSO calls.