The day the trader stops blaming the markets, politicians, or ‘They’ and ‘Them’ for losses and starts taking responsibility for their own trading could be the day that they begin to change from losing money to making money. In the end the market is like the ocean and we are the surfer, we choose the surfboard and the waves and the ocean really doesn’t care what we do it’s just there. The quality of our ability to ride a wave is based on our skills, technique, and experience our emotions contain no edge. In the end we win or lose based on our ability to overcome our own weaknesses.

Market price action is neutral to our existence, it is our method that determines our profitability and we choose how we will trade.

Profitability comes from our total trading profits being bigger than our total trading losses, we control our entries and exits.

The size of our draw down in capital is determined by the quality of our risk management and we manage our own risk.

Trading too big for a trading account size almost guarantees failure, we control our own position sizing.

Profitability only comes from trading with an edge, we are responsible for finding and trading with our own edge.

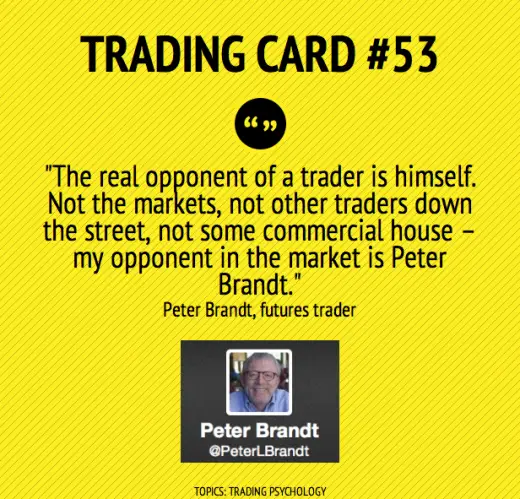

Trading Card #53: The Real Opponent Of A Trader Is Himself, by @PeterLBrandt http://t.co/ROjVh1GCRs

— Henri Simoes |trader (@TraderHMS) October 15, 2013