2. I see the younger generation hampered by the need to understand and rationalize why something should go up or down. Usually, by the time that becomes self-evident, the move is already over.

3. When I got into the business, there was so little information on fundamentals, and what little information one could get was largely imperfect. We learned just to go with the chart. Why work when Mr. Market can do it for you?

4. These days, there are many more deep intellectuals in the business, and that, coupled with the explosion of information on the Internet, creates an illusion that there is an explanation for everything and that the primary test is simply to find that explanation. As a result, technical analysis is at the bottom of the study list for many of the younger generation, particularly since the skill often requires them to close their eyes and trust price action. The pain of gain is just too overwhelming to bear.

5. There is no training — classroom or otherwise — that can prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market. There’s typically no logic to it; irrationality reigns supreme, and no class can teach what to do during that brief, volatile reign. The only way to learn how to trade during that last, exquisite third of a move is to do it, or, more precisely, live it.

6. Fundamentals might be good for the first third or first 50 or 60 percent of a move, but the last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic.

7. That cotton trade was almost the deal breaker for me. It was at that point that I said, ‘Mr. Stupid, why risk everything on one trade? Why not make your life a pursuit of happiness rather than pain?’

8. If I have positions going against me, I get right out; if they are going for me, I keep them… Risk control is the most important thing in trading. If you have a losing position that is making you uncomfortable, the solution is very simple: Get out, because you can always get back in.

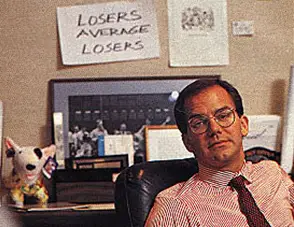

9. Losers average down losers

10. The concept of paying one-hundred-and-something times earnings for any company for me is just anathema. Having said that, at the end of the day, your job is to buy what goes up and to sell what goes down so really who gives a damn about PE’s?

11. The normal progression of most traders that I’ve seen is that the older they get something happens. Sometimes they get more successful and therefore they take less risk. That’s something that as a company we literally sit and work with. That’s certainly something that I’ve had to come to grips with in particular over the past 12 to 18 months. You have to actively manage against your natural tendency to become more conservative. You do that because all of a sudden you become successful and don’t want to lose what you have and/or in my case you get married and have children and naturally, consciously or subconsciously, you become more conservative.

12. I look for opportunities with tremendously skewed reward-risk opportunities. Don’t ever let them get into your pocket – that means there’s no reason to leverage substantially. There’s no reason to take substantial amounts of financial risk ever, because you should always be able to find something where you can skew the reward risk relationship so greatly in your favor that you can take a variety of small investments with great reward risk opportunities that should give you minimum draw down pain and maximum upside opportunities.

13. I believe the very best money is made at the market turns. Everyone says you get killed trying to pick tops and bottoms and you make all your money by playing the trend in the middle. Well for twelve years I have been missing the meat in the middle but I have made a lot of money at tops and bottoms.

14. That was when I first decided I had to learn discipline and money management. It was a cathartic experience for me, in the sense that I went to the edge, questioned my very ability as a trader, and decided that I was not going to quit. I was determined to come back and fight. I decided that I was going to become very disciplined and businesslike about my trading.

15. The most important rule of trading is to play great defense, not great offense. Every day I assume every position I have is wrong. I know where my stop risk points are going to be. I do that so I can define my maximum possible drawdown. Hopefully, I spend the rest of the day enjoying positions that are going my direction. If they are going against me, then I have a game plan for getting out.

16. Don’t be a hero. Don’t have an ego. Always question yourself and your ability. Don’t ever feel that you are very good. The second you do, you are dead. My biggest hits have always come after I have had a great period and I started to think that I knew something.

17. My major problem was not the number of points I lost on the trade, but that I was trading far too many contracts relative to the equity in the accounts that I handled. My accounts lost something like 60 to 70 percent of their equity in that single trade.

18. To do the job right requires such an enormous amount of concentration. It’s physically and emotionally mandatory that you find some time to relax. And you’ve got to be able to turn it off like that. There will be times though that I get so incredibly excited about a trade or even a project that I’ll wake up at 4 o’clock in the morning and there’s no way in hell that I’m going back to sleep. I’ll sit there in my dreams and trade for four hours.

19. Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That’s why most people lose money as individual investors or traders because they’re not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they’re going to make. Then they will be incredibly successful investors.

20. To do the job right requires such an enormous amount of concentration. It’s physically and emotionally mandatory that you find some time to relax. And you’ve got to be able to turn it off like that.