So many arguments and fights about trading that happen on social media are simply due to a lack of understanding about another trader’s methodology or time frame. So many think their way is the ONLY way to make money in the markets. But the “Market Wizards” series of books showed us that there are many ways to make money in the markets and across different markets. Profitability is not based on methodology or even a winning percentage, all traders have to do is have bigger winners than losers to make money. Whether they are a scalper with a 90% win rate or a trend follower with a 30% win rate makes no difference if they adding money to there trading accounts on a consistent basis. We all have to trade a method we are able to both believe and and trade consistently that is what matters. There is no reason for scalpers to scoff at trend followers or currency traders to think stock traders are gamblers. There is no reason for a trader to judge another trader without even knowing anything about them, there long term record, or account size.I have seen people make money buying options and people make money selling them consistently. I have seen trend followers make a killing in many markets and contrarians make a killing playing the reversals of trends. There are successful day traders, value investors, commodity traders, and CAN SLIM investors.

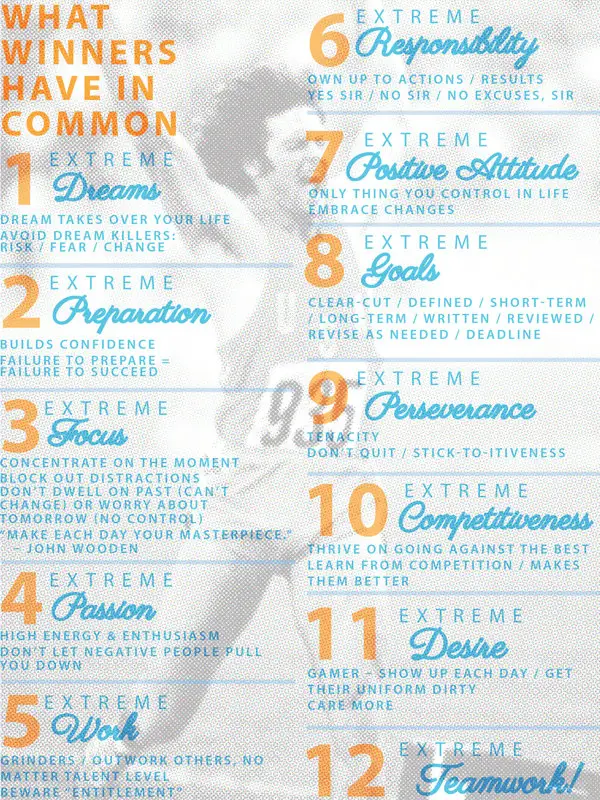

There are a few common traits for the winning traders I have seen and read about.

-

Almost all the winning traders are not egomaniacs they are flexible to what is happening with price action.

-

They are very good students of the markets and understand historical price action.

-

They focus like a laser on their specific methodology and are experts at it.

-

They believe in what they are doing with an almost religious fervor, they KNOW that what they are doing works.

-

They have nothing to prove to anyone they just trade their method.

-

They are life long learners always trying to improve and grow.

-

They have rules they follow.

-

They only trade a predetermined watch list.

-

The winning traders always remove the risk of ruin with stop losses and position sizing.

-

They don’t fight the market when wrong, they cut their losses and move on to their next trade.