“If you diversify, control your risk, and go with the trend, it just has to work.” -Larry Hite

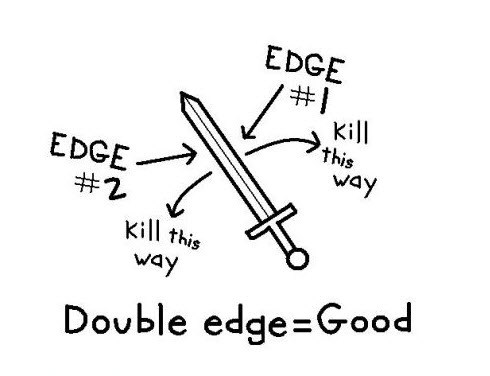

We often hear of trading with an edge, but how do we know for sure we have an edge in our trading? How do we know that the odds are in our favor, and that the more we trade, the more our accounts will grow? Are we really the casino, and not the gambler, or are our short term winnings the result of luck?

- Trading entry points in chart patterns that historically play out as a winning trades more than a losing trade. Taking entries that play out as winners only 60% to 70% of the time is better odds than a random 50/50 entry point. The key is to do your homework and know the odds of each entry from specific chart patterns. Cups with Handles, candlesticks, and triangles are just some of these patterns. Thomas Bulkowski has done some amazing work around quantifying these patterns.

- Historical price action backtesting using software and historical price data, along with technical indicators, to see how a system will do over an extended period of time in various markets. Moving averages and breakouts in different time frames are used to see what the equity curve looks like. This is the realm of the mechanical system trader. Price history gives the edge, and programming knowledge is required.

- Trade a method that has been proven historically as a winning one, one that has rules on what to buy based on fundamental or technical criteria. It should cover when to buy, how much to risk per trade, when to exit at a loss, or when to exit to lock in profits. One example of such a method is the CAN SLIM system by William O’Neil. While the system is very robust, it is more of an investing system than a trading system due to the recommended time frames for buying and holding stocks.

- Technical Analysis in the form of chart reading with support, resistance, trend lines and volume, will give a trader an edge over someone who enters randomly.

- Experienced discretionary traders can be their own edge, developed through market experience and exposure to market behavior. Successful discretionary traders are like seasoned athletes who know what to do in different circumstances based on past experience, and learning through repetitive action.

- Emotional Edge can be gained by traders who make buy and sell signals based on systems and methods instead of fear and greed. They can step in and buy in a bear market when a reversal begins with a new trend upwards, without fear. They allow winners to run in a bull market, not selling too soon out of fear of giving back profits. Traders not affected by their ego can sell quickly when they are wrong to avoid taking a bigger loss than is necessary.

- Asymmetric Risk Edge is really THE edge that produces profits in the long term. The only way to make money in the long term is to have all your winners be bigger than all your losers. This can only happen by cutting losers short and letting winners run or having a very big win percentage. A good ground rule is to only take trades that can profit $3 for every $1 at risk. Only risk $1,000 if you believe you can make $3,000 on a specific trade. Of course a day trader with a 60% win rate may be able to get by with a $2 profit for a $1 risk if they stay disciplined in cutting losses and a trend following may have amazing returns with only a 30% win rate if there wins are 5 to 10 times their risk.