“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Unknown

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Unknown

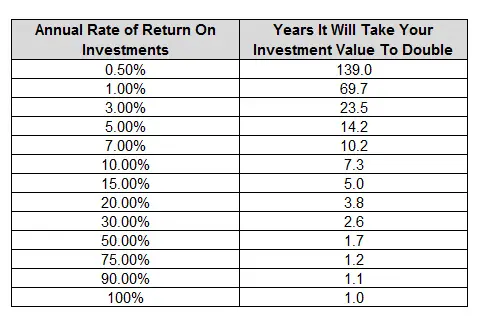

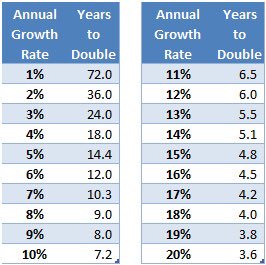

When I was a teenager, I was fascinated with compounded return tables. They seemed like magic to me. I knew that at some point in the future, I could build up my capital to the point where it made more than I did. If I managed my capital correctly, and could return 12% a year, it would double at the end of the sixth year. If I could really knock it out of park and return 20% a year, I was looking at doubling at the end of four years. The key would be to figure out how to do get these returns through the stock market, and how to get the capital in the first place. I decided I would sell my time for work, and then put that money to work in order to save time in the future.

I have been fortunate to make my teenage dreams come true, and over the past 20 years, I have created this compounding in my accounts. For me, capital preservation is the key. Grinding out 15%-20% returns a year can work magic in a few years, and if you throw in a few 40% and 50% return years in great trending markets, you can build capital quickly. When you have six figures in your personal trading accounts and 1% of capital is over $1,000, it gives you tremendous trading firepower.

If you have never pondered the power of compounding a trading/investing account for capital appreciation, please give this chart your attention. It is possible to be a millionaire in a reasonable amount of time if you leave your capital alone and let it grow. This is a program that anyone can use with simple trend following methods. Using an index and moving averages is not rocket science. Implementing this inside a tax deferred account like a 401K, 403B, or IRA eliminates the capital gain taxes. The key is to start building early at a very young age. Once you get into the six figures, the acceleration of the growth is amazing.

Using an index and a moving average as a trend filter is not rocket science.