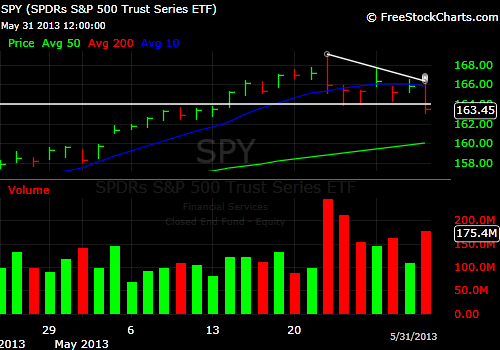

There are many reason I bought $SPY puts as it broke down Friday. The chart is screaming at me to go short, I had to listen. I entered short as it fell to the $164.60 level with my initial stop at the 10 day sma believing it would lose $164 which it did quickly. Going into tomorrow I am setting my new stop loss with a close above the $164 level. Maybe earlier if something crazy happens like central bank intervention that causes a gap up or reversal, but I am fairly confident that they are out of bullets as the Japan markets are now showing. I can’t trade what I believe I have to trade the price action in my time frame and the break out to a new low is my first attempt to catch a down trend and I am taking it.

-

$SPY lost the near term $164 support on Friday and this may become the new level of short term resistance, if price pokes back up above this level and then is rejected below it then that will confirm that we go lower.

-

If $SPY can reverse and close above the $164 level tomorrow then we start a reversal back to the 10 day or just a chop fest with increasing volatility. That will be a mess but I think it is unlikely.

-

Depending on the chart’s time frame traders are looking at and where they draw their trend lines we broke out of the bottom of a symmetrical triangle or a pennant Friday, but regardless this was a fresh 13 day low.

-

We have been making lower highs for seven straight days, that is a short term down trend.

-

Seven days ago we had a reversal candlestick.

-

Four days ago we had an island top reversal.

-

Be aware that long term trend followers signals to sell is likely a confirmation below the 50 day, if we can close below that level in the following days or weeks it could take a nice plunge lower from even there.

-

Before we get to the longer term trend followers cashing out with their big profits we have eager bulls just dying to get in at the 50 day so that level should provide an initial bounce, which is where I want to sell my puts initially then key off the 50 day for what to do next if we get there .

-

The 50 day is the next line in the sand, if we bounce and reverse from there the longer term up trend stays in place and I will look to go long and trade off that line. That will be a huge bull versus bear battle at that line.

-

The five days of greater volume was on the down days not the up days.