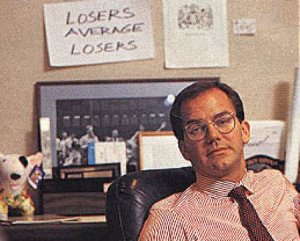

“The whole world is simply nothing more than a flow chart for capital.”

-Paul Tudor Jones

Successful trading is the attempt to be on the right side of the flow of capital. Each change in price happens with a new agreement between the current buyer and seller. Buyers and sellers are always equal for a transaction to take place, the cause of movement is determined by whether the buyers want in more than the sellers want out. Prices moves when capital flows into and out of a market, and inflow pushes up prices because demand becomes more than supply, price discovery happens to find out what sellers are willing to take to sell their position.

Many crazy over bought or over sold trends occur because one side has little pressure on it, position holders, shorts, or buyers sit tight as a trend accelerates. Equity markets rise when new money has to enter to be put to work but there is little interest at selling due to position holders sitting on winning positions.

Price resistance on a chart is caused by simply being the place that current holders are taking their profits. Price support happens at the price that people on the sidelines are ready to get back in at. These are simply spots where capital flows in and out.

Growth stocks trend higher due to the demand on it from institutional money managers, it is the flow of capital into the stock in pursuit of owning the future earnings growth that drives a stock upwards, not P/E ratios or opinions.

Finding ways to quantify and trade the flow of capital is what a winning trading method is really all about.