This interview with master trader Chris Kacher first appeared in Your Trading Edge magazine.

Like his colleague Gil Morales, Chris is a protégé of William O’Neil, the legendary investor and author of ‘How to Make Money in Stocks’. Along with Morales, Chris is one of the few to have traded O’Neil’s own funds as an in-house money manager.

What is a pocket pivot trade?

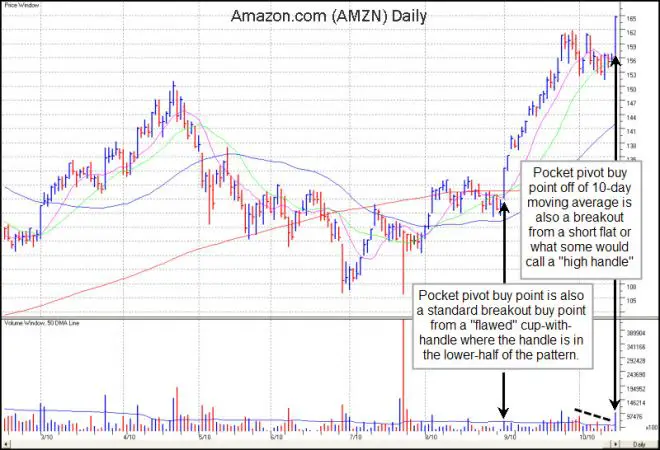

It lets you buy early in the base before the break out. So your average cost by buying the pocket pivot, then the base breakout, is lower than had you just bought the base breakout alone. You are also in a psychologically stronger position to hold onto the stock instead of getting whipped out of your position, which has been common in the 2000s.

As with breakouts, you want to focus on fundamentally and technically strong stocks in leading industry groups. The day’s volume should be larger than the highest down volume day over the prior 10 days.

1.As with base breakouts, proper pocket pivots should emerge within or out of constructive basing patterns.

2.The stock’s fundamentals should be strong, i.e., excellent earnings, sales, pretax margins, ROE, strong leader in its space, etc.

3.The day’s volume should be larger than the highest down volume day over the prior 10 days.

4.If the pocket pivot occurs in an uptrend after the stock has broken out, it should act constructively around its 10-dma. It can undercut its 10-dma as long as it shows resilience by showing volume that is greater than the highest down volume day over the prior 10 days.

5.Pocket pivots sometimes coincide with base breakouts or with gap ups. This can be thought of as added upside power should this occur.

6.Do not buy pocket pivots if the overall chart formation is in a multi-month downtrend (5 months or longer).It is best to wait for the rounding part of the base to form before buying.

7.Do not buy pocket pivots if the stock is under a critical moving average such as the 50-dma or 200-dma. If well under its 50-dma, and getting support near the 200-dma, it can be bought provided the base is constructive.

8.Do not buy pocket pivots if the stock formed a ‘V’ where it sells off hard down through the 10-dma or 50-dma then shoots straight back up in a ‘V’ formation. Such formations are failure prone.

9.Avoid buying pocket pivots that occur after wedging patterns.

10.Some pocket pivots may occur after the stock is extended from the base. If the pivot occurs right near its 10-dma, it can be bought, otherwise it is extended and should be avoided. Give the 10-dma the chance to catch up to the stock, where the stock would consolidate for a few days, before buying such a pocket pivot.

A pocket pivot buy point is a buy point created by Dr. Chris Kacher who created the pocket pivot in 2005 when the sideways choppy markets of 2004-2005 were making base breakouts fail. But what does not kill you makes you stronger, and the pocket pivot concept was born. Base breakout and gap up buy points technically fall under the pocket pivot concept which is, in essence, a favorable buy point in a stock. Buying pocket pivots are to our advantage because they get us into a stock early often before it breaks out of its base. It also enables us to add to a position in a winning stock as such stocks often have multiple pocket pivot points as they move higher.

If you miss a breakout, you can still buy into the stock when it flashes a pocket pivot point since some pocket pivots may occur after the stock is extended from the base. If the pivot occurs right near its 10-day moving average, it can be bought; otherwise it is extended and should be avoided. Give the 10-day moving average the chance to catch up to the stock, where the stock would consolidate for a few days, before buying such a pocket pivot.

What is the success rate of pocket pivots?

In practice about half of high quality stocks showing pocket pivots, even in the 90s in the middle of a beautiful bull market, won’t work. This is roughly equivalent to the success rate of standard base breakouts. So, like with any stock they buy, it’s important people keep their stops appropriately tight on every position they initiate.

My thoughts on risk management in this trade:

(What leads to success in both a base break out and a pocket pivot is your winners should be allowed to run, wins should average a 20%- 25% gain with the right CAN SLIM stocks and your losses should be cut at 7%-8% of your buy point. The risk/reward is what really leads to the long term success of this method. Also be sure that your position size does not expose more than 1% or 2% of your total account capital with the 7%-8% of your capital at risk exposed.)

(For instance, if you are trading with $100,000 you can risk $1,000-$2,000 per trade. (Your 1%-2% total capital at risk). If you trade with a $10,000 position size in a stock and risk 7%-8% of it, that is $700-$800, well below your 1% capital at risk rule.)

You can check out Chris Kacher’s book at this link ‘How to Trade Like an O’Neil Disciple.’

Chris Kacher’s ten rules for pocket pivots are shown at www.virtueofselfishinvesting.com/faqs and many chart examples are given at www.virtueofselfishinvesting.com/reports.