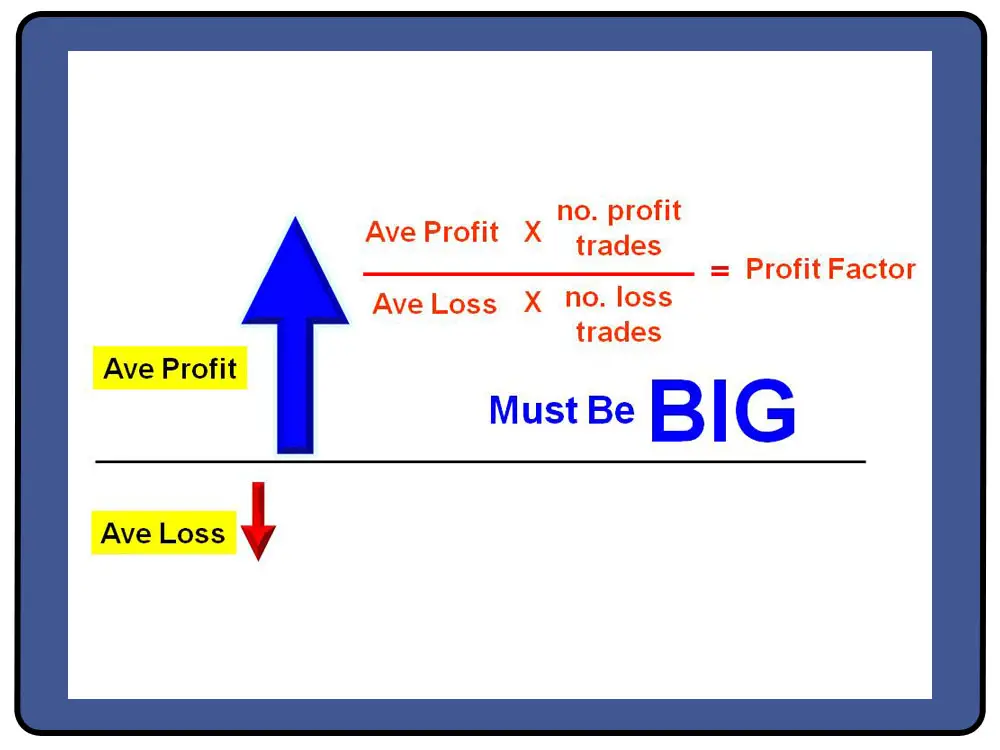

The biggest key to winning in trading is not stock picking, trend following, predicting, or a particular method of trading. Whether you are still trading a year from now or you are gone will be based on risk management. I know, boring topic. But the key to everything. The best traders in the world win not because they are right every time or even the majority of the time, they win because when they are right they ride it for all that it is worth with a trailing stop to lock in profits, and when they are wrong they admit it and they cut the loss quickly.

A winning trade is meaningless outside the context of a trading method that has rules. So what if you made $1,000 day trading this morning, how much have you made this year? This month? The past 5 years? What is your risk of ruin? Will you even be around if you lose the next 10 trades in a row? You will not if you are risking 10% of your capital on each trade.

If you have 5 stock positions and you cut your losses at a maximum of 1% of your trading capital on a $100,000 account and let your winners run as far as they will until they stop, then 5 trades might look like this:

$AMZN Loss $1000 $GOOG Loss $1000 $NFLX Loss $1000 $PCLN Profit $10,000 $AAPL Profit $20,000You are up $27,000 after these five trades, now what if you hate cutting losses but want to lock in profits at your own set profit targets, then you could look like this:

$AMZN Loss $5000 $GOOG Loss $4000 $NFLX Loss $20,000 $PCLN Profit $5,000$AAPL Profit $5,000

Now you are down $19,000 by letting losers run and cutting winners short. Also I would say that all of us holding AAPL would have never predicted a $220 point run off the 50 day moving average, we just held on for the ride of our lives as long as we were not stopped out on a pull back below a key moving average . Also the people that experienced the painful crash in NFLX would have never believed that it would have fallen so far. They may have added to their position on the way down. Never add to losers, sell them for your accounts long term health. It may turn around and come back, but the one time that it doesn’t your account is cooked.The day you stop trying to predict winners and losers and begin to let your stop losses and trailing stops do their job you will begin to win. If you think you are personally smarter than the sum total of market participants you have already lost.