I have had a great year trading thanks to my choice to trade Apple stock. I knew that it had the potential to trend in 2012 with it being such a dominating company in its industry. While fundamentals are good for building a watch list I believe that the charts have all the information we need. Investors and traders beliefs about the companies future is reflected in the chart. To be successful in trading we must trade the chart not the company or economy. Definitely not our own opinions like we know better than the agreed upon price of all market participants.

Apple is my favorite monster stock, over the past decade it has been one of the greatest performing stocks in history. If you own a stock and also carry their products in your pocket that is a good sign, especially if they have great products that dominate their industry.

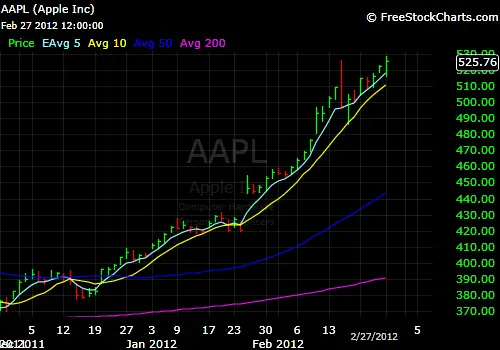

I recommend buying or adding to an existing position near but above the 5 day exponential moving average.

Only risk 1% of your capital per trade. If you have a $50,000 account you can risk $500 on this trade which with the current volatility would be about 50 shares or one option call contract that is in the money.

Cut your losses if Apple loses its 5 day exponential moving average and does not retake it by the close. A huge red alert for Apple bulls would be a loss of the 10 day simple moving average that is not retaken by the close.

My goal in trading is to enter and hold a stock rising day after day for big gains. As you look at this first chart realize that I was long this stock every day that it was above the 5 day ema. I was out the day of the big red bar because volatility expanded greater than my risk model paired with the fact that my call option expired that Friday and I was $78 deep in the money, so I had to exit.

I would not short this stock unless something truly disastrous happens that is currently beyond my imagination.

This is not a parabolic move, this is a revaluing of the stock based on growth estimates after its earnings announcement like the stock has done for the past ten years.

If you have not spent time reviewing charts of the greatest performing stocks of all time then let me give you a look at your first one: