Ed Seykota Strategy

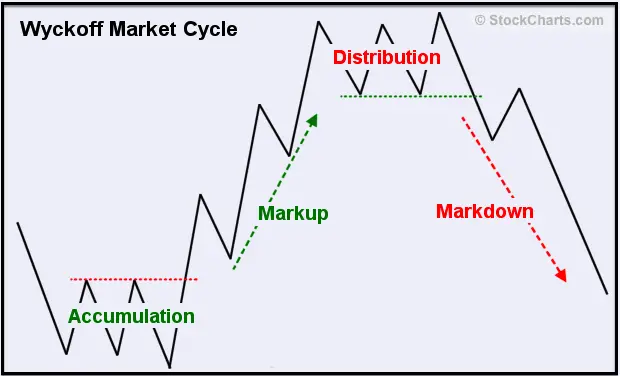

Ed Seykota is a trend following trader that uses reactive technical analyses through quantified trading signals to capture large profits during trending price action. He has parameters for proper position sizing, volatility filters, and optimizes his strategy for large wins and small losses. Ed Seykota Trading Rules “In order of importance to me are: 1) […]

Ed Seykota Strategy Read More »