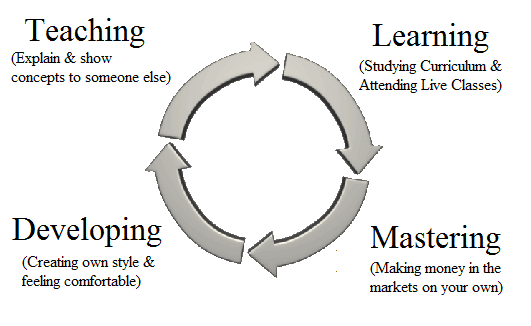

Before you spend any money on anything related to trading ask yourself this question. “Am I buying into hope in a magical trading system or am I learning to trade on my own?” The best trading teacher you can have is one that has the goal to train you in a way that you will eventually no longer need a teacher, the worst thing you can buy into is service that seeks to make you dependent on them permanently. You want to graduate from school not live there. You want your mentor relationship to eventually evolve into a friendship and become peers not allow your mentor to become an infallible guru that you pay the rest of your life.

There are professionals that have track records managing real money that consult with corporations and train the companies’ traders. These are the best of the best training in all the key areas of trading, risk management, liquidity, seasonality, risk of ruin, trader psychology, market making, risk/reward ratios, system development and back testing along with all the other areas needed for market makers, hedgers, and producers of commodities along with how to generate alpha for a firm. The best of these trainers are not academics but practitioners.

The worst of the worst people to learn from are the fakes in social media and online. These people are not even profitable traders but run a ‘business’ that makes money only from subscribers. I highly doubt they even trade due to the lack of knowledge they seem to have about the key core concepts that make trading profitable like risk management, psychology, and position sizing and many other things that if you mess a key area you will never make it as a trader. They are the newsletter writers or chat room operators that flood their subscribers with ‘picks’ then they are quick to announce their winning ‘picks’ from the roof tops as they hide their losing ‘picks’ under the rug. It is surprising to me how little I ever hear of any successful subscribers stories, most are just short blurbs from subscribers after a short winning streak on the newsletter writers site.

Another alarming thing I see is one outspoken snake salesman that touts his two successful millionaire trading students. Now this is someone that has had students for at least seven years and likely thousands and thousands of students. Two winners can be attributed to randomness and taking on way too much risk. Also he never says 3,000+ other students blew up their accounts which is what I suspect. If you are going to brag I am impressed with statistics of subscribers or how a model portfolio performed not just spouting noise to trick the masses.

Now before the hate messages start flowing my way I will say there are also newsletters that know who they and are giving picks for a defined system. Some traders like them becasue they do the work for them of finding entries, signals, and patterns that they are looking to trade anyway and it is a complement to the writers real trading. I have no issue with these services and some of my friends do this. My concern is not with the professionals that teach real trading or real traders that piggy back their real trading with services, what I am speaking out against is the frauds, scam artists, and paper traders that play make believe and take subscribers money.

There are two things people Are selling In the trading world: One group are selling their services to teach people all the things they need to know to become traders and the other group is selling hope pushing paper trading picks promising an easy path to big money that does not exist in this world because if it was as easy as many of the fakes pretend trading to be they would be billionaires not selling $29.95 monthly subscriptions on social media.

“As my lovely old Dad always told me, trust those who promise the least.” – Neil Sims