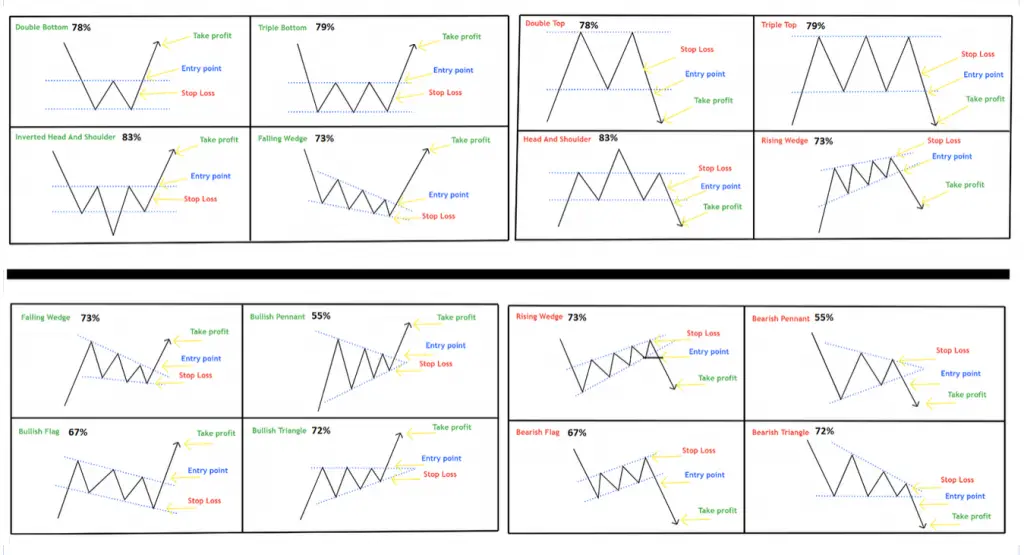

Rising Wedge vs Falling Wedge

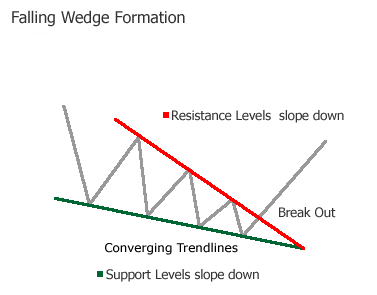

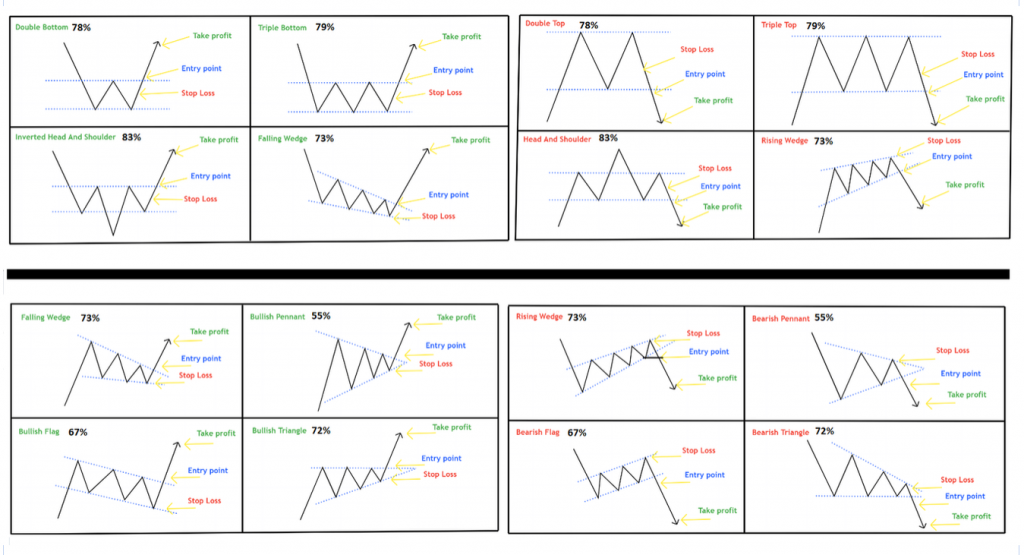

A Rising Wedge is a bearish chart pattern that forms during a downtrend in price action that has upward trend lines. A Falling Wedge is a bullish chart pattern that forms during an uptrend in price action with downward trend lines. Wedge patterns can be continuation or reversal patterns depending on which way they breakout. […]

Rising Wedge vs Falling Wedge Read More »