Dr. Michael Burry is the legendary investor that runs the Scion Asset Management hedge fund. He became famous through his inclusion in the best selling book “The Big Short” by author Michael Lewis that was also made into a blockbuster movie. Dr. Burry was played in the movie by Christian Bale and his character was a central figure in the movie.

Burry’s most famous trade was using derivatives to bet against the real estate market in 2007-2008. He has turned into one of the most famous and watched bears on Wall Street. He is active on Twitter and has been making some very bearish calls in recent years and believes there is a lot more pain to come in the financial markets.

His fame rose again with his big deep value Gamestop investment during the Wall Street bets run up in price in 2021.That would have been a billion dollar trade for him if he would have held his $GME shares a few months longer that year. He did have triple digit returns on that investment from entry.

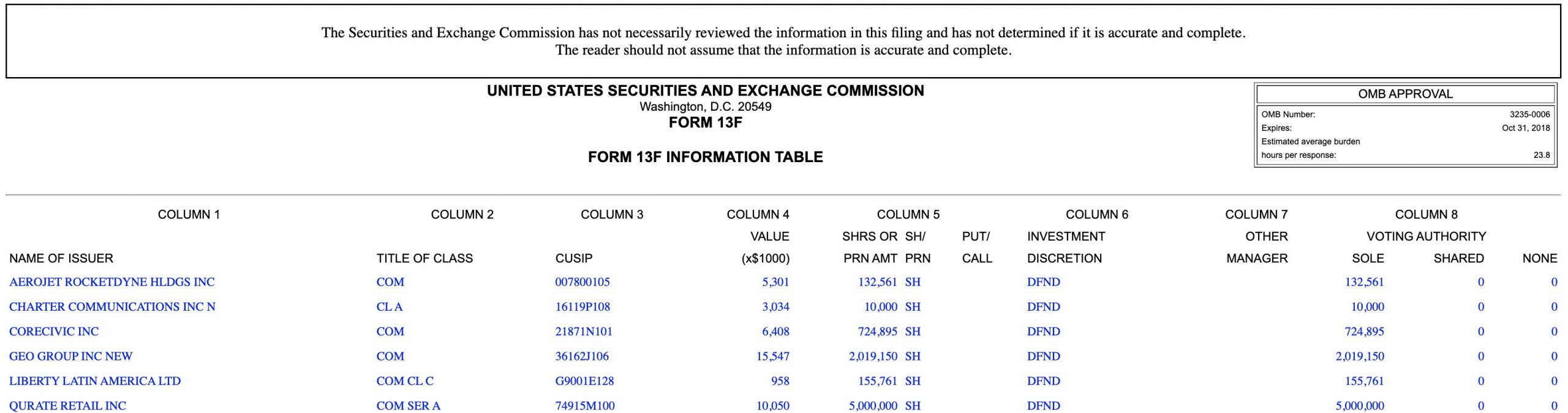

Below is the Michael Burry portfolio today based on the 3rd quarter 13f filing as of 9/30/22 with the SEC. Burry’s total holdings now total $41,298,000 in value and has six total positions after adding five new positions in the three months after the second quarter filing. He was only holding Geo group Inc. stock in the second quarter of 2022. He added 1.5 million more shares to his initial 500,000 share GEO position in the 3rd quarter.

This is a lot bigger equity position for Burry as he has been selling short via put options in the past 18 months, had only one stock position in the second quarter, and has been very bearish for years. His calls for runaway inflation before it even started was accurate as well as his recent call that white collar workers in the tech and information industries were over hired and that would lead to layoffs which has begun.

He now believes that index funds as an sub-asset class are in a bubble and due to crash as investors are overexposed to the S&P 500 index with little regard for the fundamental valuations of individual companies that make up the index. He believes stock indexes are due for crash as equities as an asset class are unloaded in mass as the current recession deepens.

So let’s take a look at what he was holding in stock positions coming into October 1st, 2022, still a very defensive portfolio.

Michael Burry Portfolio Q3 2022

Rank/Ticker/Company/Portfolio Percentage

- GEO – GEO Group Inc. 37.65%

- QRTEA – Qurate Retail Group Inc. CL A 24.34%

- CXW – CoreCivic Inc. 15.52%

- AJRD – Aerojet Rocketdyne Holdings 12.84%

- CHTR – Charter Communications 7.35%

- LILAK – Liberty LiLAC Group C 2.32%

What is Michael Burry investing in?

Michael Burry portfolio allocation 2022 Q3:

Services 47.32%

Consumer Discretionary 24.34%

Financials 15.52%

Industrials 12.84%

Burry’s portfolio is now over 50% in prison stocks with GEO and CXW.

GEO – GEO Group Inc: GEO’s diversified services include enhanced in-custody rehabilitation and post-release support through the award-winning GEO Continuum of Care, secure transportation, electronic monitoring, community-based programs, and correctional health and mental health care. GEO’s worldwide operations include the ownership and/or delivery of support services for 102 facilities totaling approximately 82,000 beds, including idle facilities and projects under development, with a workforce of up to approximately 18,000 employees.

QRTEA – Qurate Retail Group Inc. CL A: The company markets and sells various consumer products primarily through merchandise-focused televised shopping programs, Internet, and mobile applications. It also operates as an online retailer offering women’s, children’s, and men’s apparel; and other products, such as home, accessories, and beauty products through its app, mobile, and desktop applications. The company serves approximately 200 million homes worldwide.

CXW – CoreCivic Inc.: CoreCivic, Inc. owns and operates partnership correctional, detention, and residential reentry facilities in the United States. The company provides a range of solutions to government partners that serve the public good through corrections and detention management, a network of residential reentry centers to help address America’s recidivism crisis, and government real estate solutions. Its correctional, detention, and residential reentry facilities offer rehabilitation and educational programs, including basic education, faith-based services, life skills and employment training, and substance abuse treatment. As of December 31, 2021, the company owned and operated 46 correctional and detention facilities, 26 residential reentry centers, and 10 properties for lease.

AJRD – Aerojet Rocketdyne Holdings: Aerojet Rocketdyne Holdings, Inc. designs, develops, manufactures, and sells aerospace and defense products and systems in the United States. It operates in two segments, Aerospace and Defense, and Real Estate.

CHTR – Charter Communications: ommunications, Inc. operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States. The company offers subscription-based video services, including video on demand, high-definition television, digital video recorder, pay-per-view services. It provides Internet services, such as security suite that protects computers from viruses and spyware, and threats from malicious actors; in-home WiFi, which provides customers with high performance wireless routers to enhance their in-home wireless Internet experience; out-of-home WiFi; and Spectrum WiFi services, as well as video services.

LILAK – Liberty LiLAC Group C: Liberty Latin America Ltd., together with its subsidiaries, provides fixed, mobile, and subsea telecommunications services. The company operates through C&W Caribbean and Networks, C&W Panama, Liberty Puerto Rico, VTR, and Costa Rica segments. It offers communications and entertainment services, including video, broadband internet, fixed-line telephony, and mobile services to residential and business customers; and business products and services that include enterprise-grade connectivity, data center, hosting, and managed solutions, as well as information technology solutions for small and medium enterprises, international companies, and governmental agencies.[1]

Michael Burry Net Worth 2022

The current Michael Burry net worth in 2022 is estimated to be approximately $300 million based on several sources.[2]

Michael Burry Twitter

Michael Burry’s tweets on Twitter are always interesting to read, he has a habit of deleting his tweets after he sends them and also deactivating his account from time to time. Here is his real Twitter account: @michaeljburry, he recently lost his blue verification checkmark after too many account deactivations. Here is an archive of his past tweets here.